In the world of yachting, the horizon is limitless, but fiscal borders are very real. While the European Union often dominates the conversation due to its complexity, a global yacht owner must understand the distinct tax landscapes of the Americas, the Caribbean, and beyond.

At Windward Yachts, we ensure your navigation is seamless, not just oceanographically, but fiscally. Here is your essential guide to yacht taxation across the key sailing hubs of the world.

1. The European Union: The “Free Circulation” Standard

In the EU, the concept is binary: a yacht is either “VAT Paid” or it is not.

- The Rule: To move freely between Member States (e.g., France to Italy), VAT must be paid in one of them.

- Non-EU Residents: You can utilize Temporary Admission (TA). This allows a non-EU flagged yacht, owned by a non-EU resident, to cruise for 18 months tax-free.

- Chartering: VAT is strictly applied based on where the charter starts. Note that the “high seas” tax exemptions are being phased out in favor of strict “time spent in territorial waters” calculations.

Read also: Buy or Rent a Yacht: Find the Perfect Option for Your Lifestyle and Dreams

2. The United States: Cruising Licenses & State Tax

The US does not have a federal “VAT.” Instead, it operates on a system of “Sales and Use Tax” which varies by state, alongside specific federal cruising permits.

- The Cruising License: Foreign-flagged yachts (over 79ft) can apply for a Cruising License. This allows you to navigate US waters without formally “importing” the yacht and paying duty, usually for one year (renewable).

- Florida’s “Cap”: Florida is the yachting capital of the US. The state imposes a 6% Sales Tax, but with a crucial advantage: the tax is capped at $18,000 (plus discretionary sales surtax), regardless of the vessel’s value. This makes Florida an attractive “home port” for tax purposes compared to other states.

Read also: US Tariffs on EU Exports: Impact on the Yachting Sector

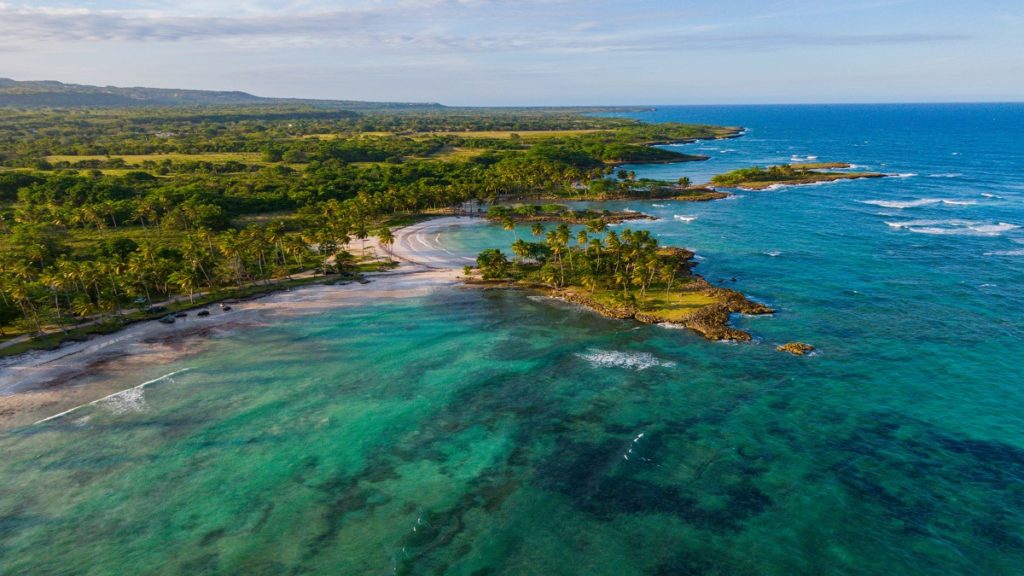

3. The Caribbean: A Patchwork of Jurisdictions

The Caribbean is not a single fiscal entity. It is a mix of independent nations and overseas territories, each with its own rules.

- French West Indies (St. Martin, St. Barths, Guadeloupe):

- St. Barths: A tax haven. There is no VAT on yachts here, making it a favorite for transactions.

- Guadeloupe/Martinique: As part of France, EU rules apply, but often with lower local tax rates (Octroi de Mer) compared to mainland Europe.

- British Virgin Islands (BVI) & Bahamas: These nations generally do not charge “VAT” on the vessel’s hull value for visitors. Instead, they rely on Cruising Permits and charter fees (e.g., the 4% charter tax in the Bahamas). However, importing a boat permanently to these islands triggers high import duties.

4. The United Kingdom: The Post-Brexit Landscape

Since leaving the EU, the UK is now a “Third Country.” This has significant implications:

- Loss of Free Circulation: A UK VAT-paid yacht does not automatically have free circulation in the EU, and vice versa.

- Returned Goods Relief (RGR): If you exported a boat from the UK, you may be able to re-import it without paying tax again, provided it hasn’t changed ownership and returns within 3 years (though specific waivers exist for pre-Brexit vessels).

- Temporary Admission: EU boats can now visit the UK under Temporary Admission, and UK boats can visit the EU under the same regime (18 months).

Read also: Your Guide to Navigating Yacht Purchase Formalities

5. Non-EU Mediterranean: Montenegro & Turkey

These destinations are popular specifically because they sit outside the EU tax net.

- Montenegro: Long considered the tax darling of the Adriatic. While fuel remains duty-free for private and commercial vessels, the VAT on charters is currently 7%, which is significantly lower than the 20-22% average in the EU.

- Turkey: Turkey operates a “Transit Log” system. Foreign yachts can stay for up to 5 years without importation duties, provided the owner is not a Turkish resident.

Conclusion: The Importance of a Global Strategy

A yacht purchased in Florida, flagged in the Caymans, and chartering in the Mediterranean requires a sophisticated fiscal strategy to avoid double taxation or customs seizure.

At Windward Yachts, we look at the whole map. We help you navigate the interaction between your flag state, your residency, and your cruising grounds.

Read also: Why will the super rich always own yachts? Our take as a broker

Need Clarification?

Fiscal laws change with the tides. Contact Windward Yachts today to ensure your vessel is compliant, wherever your compass points.